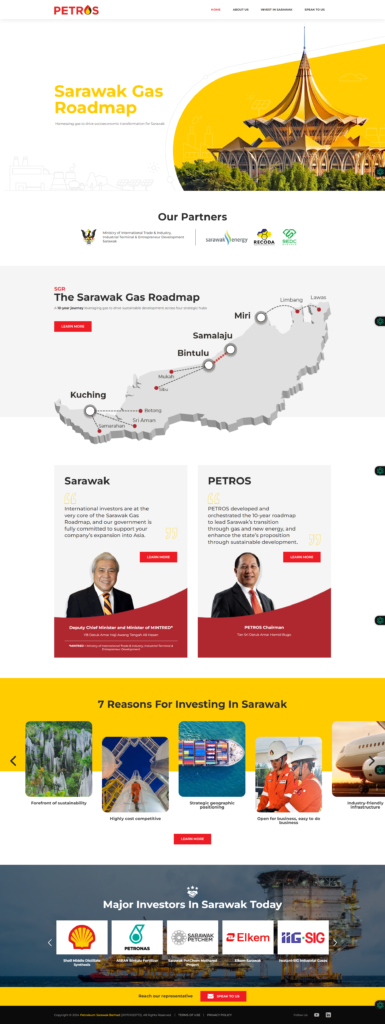

Sarawak Gas Roadmap

https://sgr.petroleumsarawak.com/

Malaysia’s Sarawak targets green energy powerhouse status

InvestSarawak CEO sees renewables as ‘cornerstone’ of sustainability for state KUCHING, Malaysia — In an ambitious pivot away from its entrenched oil and gas legacy, Malaysia’s Sarawak is working to carve out a new identity as Southeast Asia’s emerging green energy powerhouse, the head of the state’s investment agency told Nikkei Asia. The state, located on the island of Borneo that Malaysia shares with Indonesia and Brunei, possesses immense energy resources. Its operational hydroelectric dams include Bakun and Murum, while the under-construction Baleh Dam is slated to add 1,285 megawatts to the grid by 2026. Sarawak Energy, the state’s power company, estimated that Sarawak has a potential 20,000 MW of hydropower over about 50 sites, of which 3,452 MW has been harnessed. The Bakun Dam, Sarawak’s largest hydroelectric project and one of Southeast Asia’s most significant, was completed in 2011. The 7.4 billion ringgit ($1.56 billion) facility spans the Balui River and boasts a capacity of 2,400 MW. Its construction was part of a broader initiative to reduce reliance on fossil fuels and promote sustainable energy sources within the region. “Sarawak is transcending its traditional energy models to embrace a future where renewable energy is the cornerstone of economic and environmental sustainability,” Timothy Ong, chief executive of InvestSarawak, said in an interview last month. “The future of Sarawak lies in green energy, and our commitment to this vision is unwavering,” Ong said. “Through strategic investments, partnerships, and a dedicated workforce, we are not just imagining a sustainable future; we are actively building it.” The effort is paying off, attracting a slew of foreign direct investment into the green sector. In 2023, Sarawak drew 21.4 billion ringgit in investments, with a significant chunk funneled into manufacturing and renewable energy initiatives, according to Awang Tengah Ali Hassan, the state’s deputy premier, as reported by the state information office earlier this month. State-linked Sarawak Energy signed a memorandum of understanding in October last year with the United Arab Emirates’ Abu Dhabi Future Energy Company, also known as Masdar, as part of joint effort to develop 2 gigawatts of renewable energy projects in Malaysia at an investment value of $8 billion, according to the Malaysian Investment Development Authority. One of the plans includes developing 1 GW of renewable energy projects in Sarawak. Beyond hydropower, Sarawak is also aiming to become a leader in the nascent hydrogen energy industry in the region. Collaborations with Japanese and South Korean companies such as SK Energy, Sumitomo Corp. and Eneos highlight the state’s role in the ongoing international push towards hydrogen as a clean, alternative fuel source. “These ventures bring more than just investments; they bring knowledge and innovation, propelling Sarawak onto the global stage of renewable energy,” Ong said. Sarawak’s green agenda also extends to its burgeoning digital economy, with plans to power tech industries and data centers using renewable energy. The initiative aligns with global demand for sustainable digital infrastructure, marrying digitalization with green energy in a move that Ong describes as “setting the stage for a future where digital and green go hand in hand.” The road to a green future, however, is not without challenges. Sarawak is grappling with the need for skilled manpower and technological skills to drive its renewable ambitions. To this end, Ong said that InvestSarawak is focusing on education enhancements and talent repatriation strategies for “building a future-ready workforce for Sarawak’s renewable energy sector.” Ong said: “We’re focusing on enhancing local education and creating enticing opportunities for our people abroad to return and contribute to our green ambitions. This is more than just a job; it’s about building a sustainable future for our next generations.” Sarawak can play a key role in the renewable energy industry because the state can provide cost-competitive electricity tariffs. Ong reiterated that it will be serving as an anchor for energy intensive digital, advanced manufacturing. “For me, the focus is not on the value of the investment,” he said. “My focus is on our economic complexity. On investment value, it’s pointless if we don’t have sophistication in our supply chain and that is what keeps your multinationals in the state, so you can always have the attraction [for] retention of talents.”

China’s largest green hydrogen refuelling station is selling H2 at a seventh of the cost of the fuel in California

Sany claims its integrated production and fuelling complex supplies hydrogen at cost parity with diesel The largest integrated green hydrogen production and refuelling complex in China is able to supply hydrogen at 35 yuan per kilo ($4.86/kg), near cost parity with diesel, according to reporting by the Chinese newspaper Hunan Daily. Unlike the vast majority of China’s hydrogen refuelling stations, engineering firm Sany’s filling spot in the city of Changsha, Hunan province, which entered into a testing phase this week, produces its own H2 onsite via alkaline electrolysers, thus avoiding transportation costs. The electrolysers are capable of producing up to 180kg an hour, but the pumps can only dispense two tonnes per day — enough to fill up more than 100 vehicles. By way of comparison, hydrogen fuel is being sold at the pump elsewhere in China for 75 yuan per kilo — which is still cheaper than in other countries. The largest H2 fuel market in the US, California, is currently seeing pump prices of $36/kg — more than seven times higher than the Changsha facility — while in Germany, Europe’s largest market, current per-kg prices are between €12.85 and €15.75 ($14-16.60). If the price of H2 fuel in China drops below 30 yuan per kilogram, such as via future technology upgrades, “hydrogen fuel vehicles are more competitive than diesel vehicles” even without subsidies, said Wang Zhimin, director of Sany Hydrogen Energy Hydrogenation Equipment Institute. While hydrogen is often highlighted as a way to decarbonise heavy, long-haul transport, the switch from existing trucks will depend on logistics firms committing to high upfront costs or renting from emerging pay-to-use schemes such as a programme run by Shell in Germany. However, because diesel is already a relatively expensive fossil fuel, particularly in markets with higher taxes, some green hydrogen investors have suggested that the cost gap is easier to bridge than with cheap natural gas or even grey H2, potentially making it an easier sell for use in road transport than by industrial offtakers. But others have pointed out that most of the pump price at hydrogen refuelling sites is not based on the price of the H2 molecule, but the capex of the filling station as well as extra costs from compression and maintenance. While Sany appears to be leveraging economies of scale, the 37-million-yuan station will not be open to the public but rather supply fuel-cell trucks used in company operations — which could limit its utilisation rate. Similarly, although the engineering firm uses solar panels to power the electrolysers, it is unclear whether the complex has another source of renewable electricity or uses grid power for production during night.

China’s emissions, efficiency targets under threat after falling short in 2023

Bloc commits to mobilize $10.8bn for ASEAN sustainable projects SINGAPORE, March 12 (Reuters) – China is falling short on key targets for tackling climate-warming emissions, and analysts said Beijing’s credibility in global climate talks could be at risk unless it redoubles its efforts to get back on track. The Chinese government has rarely missed targets in the past. But now, driven primarily by energy security concerns, it has shown little political will to address the emissions gap, analysts said. China’s National Development and Reform Commission (NDRC), a planning agency, promised last week to “redouble efforts in energy conservation and carbon reduction” this year after it “fell short of expectations” in 2023. Analysts say it is well behind on its goal to slash energy intensity by 13.5% and carbon intensity by 18% between 2021 and 2025. The intensity rates – measuring how much energy is consumed and how much carbon dioxide emitted per unit of economic growth – are a key part of the country’s pledge to bring emissions to a peak before 2030 and to net zero by 2060. Keeping its targets within reach would require “concerted efforts across all sectors to bridge the gap”, said Jom Madan, senior research analyst with the consultancy Wood Mackenzie. But the planning commission set targets for 2024 that fall far short of what is needed. For energy intensity, the commission mandated only a 2.5% reduction. It set no new target for carbon intensity, and made no new moves to curb the use of coal – the most polluting fossil fuel. Madan predicted that China might “come close … but not quite achieve its targets” on energy efficiency. If the country misses its 2025 targets, it could raise doubts worldwide about its ability to rein in emissions. The country also risks a “serious loss of diplomatic credibility,” said lead analyst Lauri Myllyvirta of the Centre for Research on Energy and Clean Air. “China has long emphasised its ability to implement the country’s commitments, while criticising others for setting lofty targets,” he said. The NDRC did not respond to a request for comment. As the world’s biggest carbon polluter and second-largest economy, China has faced growing international pressure to show more climate ambition. It has resisted, arguing that it is already doing more than most fast-developing countries. China’s rising emissions account for 35% of the world’s annual total. On a per capita basis, the emissions level is 15% higher per capita than the OECD average, the International Energy Agency said last week. To meet its goals, Beijing should focus on efficiency improvements in industry and construction, and offer more financial support for companies to replace or retrofit outdated facilities, Madan said. Expanding the carbon market would also help, he added. NEW REALITY Officially, China’s energy intensity fell 0.5% in 2023, the country’s statistics bureau said last month, missing a 2% target. The gap would have been worse, but China last month removed non-fossil fuels such as nuclear and renewable energy from the equation to focus on tackling fossil fuels. China is applying this definition retroactively, Myllyvirta said. Without the change, the energy intensity calculation would have shown an increase of 0.5%. Myllyvirta estimated that China would need to cut energy intensity by 6% in 2024 and 2025 to meet the 2021-2025 target – far higher than the 2.5% goal set this week. Energy intensity might matter less in the future, however, said Ma Jun, director of the Beijing-based Institute of Public and Environmental Affairs. The change in how it is calculated “reflects a new reality” for China, in which economic growth is increasingly driven by the renewables sector, and fossil-fuel dependent industries will come under more pressure to boost efficiency, Ma said. “That means carbon intensity is going to matter more,” he said. Although China set no new targets for carbon intensity, the country’s economic growth implies the measure will fall about 3% this year, analysts said. However, after dropping 4.6% from 2020 to 2023, carbon intensity would need to drop about 7% this year and next to reach the 2025 goal, Myllyvirta said. Missing climate targets is unusual for China, which has made job promotions contingent on environmental progress to encourage workers and agencies to meet goals. In 2022, China’s corruption watchdog warned that some regions were providing fraudulent energy and carbon intensity figures that were overly positive. Pressure to comply with intensity targets also caused economic disruptions in 2010, with provinces cutting power supplies to energy-intensive industries and forcing homes to ration electricity. Without a major boost to its climate efforts now, “meeting the five-year intensity targets by 2025 will be very challenging,” said Li Shuo, director of the China Climate Hub at the Asia Society Policy Institute in Washington. “This year’s government work report certainly did not signal that level of decisiveness,” Shou said.

Germany launches green subsidies for industry

Bloc commits to mobilize $10.8bn for ASEAN sustainable projects BERLIN, March 12 (Reuters) – Germany on Tuesday launched a bidding process for subsidies to support energy-intensive firms switching to green production in a 4 billion euros ($4.37 billion) funding round, the economy ministry said on Tuesday. As part of Germany’s ambitions to become climate-neutral by 2045, Berlin plans to award companies in sectors such as steel, glass, paper and chemicals 15-year subsidies in return for reducing carbon emissions in production. The European Commission has approved the instrument where companies will be selected through a bidding process while competing over cutting emissions at the lowest cost. Through the so-called climate protection contracts, companies will be compensated for the extra costs of green production in industries where climate-friendly production processes cannot currently operate competitively. “Today is a good day for Germany as an industrial location, for climate protection and for sustainable jobs in our country,” said Economy Minister Robert Habeck. Berlin had originally planned to offer subsidies up to a mid double-digit billion euro sum, but the programme was put at risk by last year’s constitutional court ruling stopping the government from using some 60 billion euros of debt for climate protection projects. ($1 = 0.9148 euros)

EU official praises green energy push by Malaysia’s Sarawak

Bloc commits to mobilize $10.8bn for ASEAN sustainable projects Six major ports function as crucial transhipment hubs that play integral roles in the state’s supply chain by NURUL SUHAIDI KUCHING, Malaysia — Sarawak, a resource-rich state in Malaysia with an ambitioussustainable energy agenda, is drawing interest from the European Union, but the 27-nation group’s top official in the country says the bloc needs new cooperativemechanisms for its companies to take advantage of the opportunity. “We have seen the opportunities and the vision of the state, bringing in hydrogen,sustainable transition to green energy and energy transition,” Michalis Rokas, the EUambassador to Malaysia, said in a speech at the EU-Malaysia Business Day 2024 eventheld on Feb. 14 in Kuching, the capital of Sarawak, which is located on the island ofBorneo.Malaysia is the EU’s third largest trading partner in ASEAN, while the EU is the fourthlargest destination for Malaysian exports. The EU is also the second largest source offoreign direct investment for Malaysia at 25.2 billion euros in 2022. Still, Rokas acknowledged the limited presence of European businesses in Sarawak. Tobridge this gap, he proposed a “blending” model whereby European companies wouldtake the lead in strategic investments, while the EU would provide financial supportthrough grants, guarantees and concessional loans through the European InvestmentBank (EIB). This approach aims to de-risk projects and attract private capital,accelerating Sarawak’s green ambitions.Rokas also said the potential partnership aligns with the EU’s Indo-Pacific Strategy,which emphasizes fostering partnerships with regional countries on issues like climatechange and clean energy. Sarawak’s focus on developing hydrogen production,sustainable aviation fuel, and transitioning away from fossil fuels resonates with theEU’s own sustainability goals. The EIB has been active in Southeast Asia for over three decades, financing projects invarious sectors such as energy, transport, climate action and infrastructure. In 2022, itopened a regional representative office in Jakarta to further strengthen its engagementin Indonesia, Vietnam, Cambodia, Laos and the Philippines. Nikkei Asia understandsthat the bank has been attempting to operate in Malaysia since 2020. Its application ispending government approval for a framework agreement.Rokas also said during his speech that the EU and its 15 member states with a presencein Malaysia will be working on a plan to propose a Global Gateway flagship project inSarawak.Meanwhile, the state’s deputy premier Awang Tengah Ali Hassan welcomed thepotential partnership, highlighting the existing trade relationship between Sarawak andthe EU, which stood at 2.1 billion euros in 2022. He emphasized the state’s commitmentto renewable energy, with a target of generating at least 60% of its power from cleansources by 2030. Sarawak, abundant in oil, gas and timber, is the only Malaysian state with more than70% renewables in its energy mix, mainly from hydroelectric dams. It has threeoperational large-scale hydroelectric dams, with a fourth, Baleh, under construction.The total installed capacity of the operational large-scale hydroelectric dams in Sarawakis 3,452 megawatts. Once Baleh is completed, the total capacity will increase to 4,737MW.Last year, Sarawak announced plans to sell one gigawatt of renewable energy toSingapore via a 700km undersea cable by 2032.“We seek to establish a stronger connection between Sarawak and Europe,” Awang saidat the business event. “I hope this will serve as a venue to forming new networks andposing new paths which yield fruitful outcomes towards an inclusive economy.” Headded that Sarawak’s green push has led to collaborations with global players fromSouth Korea and Japan to develop the hydrogen industry in the state.Sarawak is already embarking on two major hydrogen production projects — withJapan’s Eneos and Sumitomo Corp. on one called H2ornbill, and South Korea’sSamsung Engineering, Posco and Lotte Chemical on another dubbed H2biscus — in theport town of Bintulu, where one of the world’s largest LNG complexes is located.The Sarawak state legislative assembly building and Sarawak River in Kuching, Malaysia. (Photo by Norman Goh)4/2/24, 2:01 PM EU official praises green energy push by Malaysia’s Sarawak – Nikkei Asiahttps://asia.nikkei.com/Business/Energy/EU-official-praises-green-energy-push-by-Malaysia-s-Sarawak 5/5Get our Asia daily briefing newslettersnewsletter@nikkeiasia.com RegisterThe two projects will have the potential to produce up to 238,000 tonnes of greenhydrogen annually, generating an estimated 2.4 billion ringgit to Sarawak’s grossdomestic product by 2030, according to Abang Johari, the state’s premier during hisannual new year address in January.Sarawak also boasts, according to the premier, ASEAN’s first integrated hydrogenproduction plant and refueling station, powering hydrogen buses in Kuching since 2018and a tram on a test basis beginning last year.Also, a third hyrdogen project is based in Rembus, near Kuching, for domestic use andis expected to be fully operational in 2025, according to state-linked company SEDCEnergy and the Sarawak Economic Planning Unit. On Monday, SEDC Energy signed anagreement with Gentari, a subsidiary Malaysia’s state energy conglomerate Petronas todevelop the Sarawak H2 Hub in Bintulu, according to a statement by Gentari.Total hydrogen industry investment in Sarawak is estimated to be worth at $4.2 billion,an SEDC Energy spokesperson told Nikkei Asia.Hydrogen produced in Sarawak is known as green hydrogen — produced via electrolysisand powered by renewable electricity from hydroelectric dams. Additionally, the state ispioneering the production of crude algae oil for sustainable aviation fuel usingmicroalgae.Timothy Ong, the chief executive of the newly established state investment promotionagency InvestSarawak said at a panel session that Sarawak is not only in competitionwith other regions of Malaysia, but with countries like Vietnam, Indonesia, Thailandand Singapore as well.“Although a lot of people come to Sarawak for renewable energy, I can comfortably tellyou today that we have more demand than available supply when it comes to renewableenergy,” Ong said. He added it is important for the state to understand that investmentbenefits must trickle down to the people of Sarawak and companies and not just remainin the hands of foreign or domestic investors.

Japan’s Sumitomo and Eneos toproduce green hydrogen in Malaysia

Hydroelectric-derived power will boost decarbonization drive TOKYO — Oil company Eneos and trading house Sumitomo Corp. will produce “green”hydrogen in Malaysia and export much of it to Japan under plans announced Monday,hoping to further diversify the supply of the fuel essential for decarbonization. The two Japanese companies have signed an agreement with SEDC Energy, a subsidiaryof the Sarawak Economic Development Corp. set up by the Malaysian state of Sarawak.They will also consider establishing a special-purpose company with the Malaysianpartner. Power from hydroelectric plants will be used to electrolyze water to produce the greenhydrogen without emitting carbon dioxide. The aim is to produce 90,000 tonnes a yearby 2030. The scale of investment will be finalized moving forward. SEDC Energy will take the lead on power procurement and hydrogen production, withEneos to provide technical support for the production. Eneos will also contributeproprietary technology for transporting the hydrogen by sea at room temperature.Sumitomo will evaluate project feasibility and financing. Hydrogen, which does not produce CO2 when burned, is essential for decarbonizationin such fields as power generation, transportation and manufacturing. But it isexpensive to produce in Japan, where renewable-energy costs are high. The Japanese government has set a goal of increasing the supply of hydrogen in Japanto 3 million tonnes per year by 2030, and Eneos and Sumitomo are working to produceand transport green hydrogen from around the world.